Section 12: Financing & Money Management

Mickey’s Rule: Build a Better Mousetrap & EWH’s Rule: Positive Cash Flow

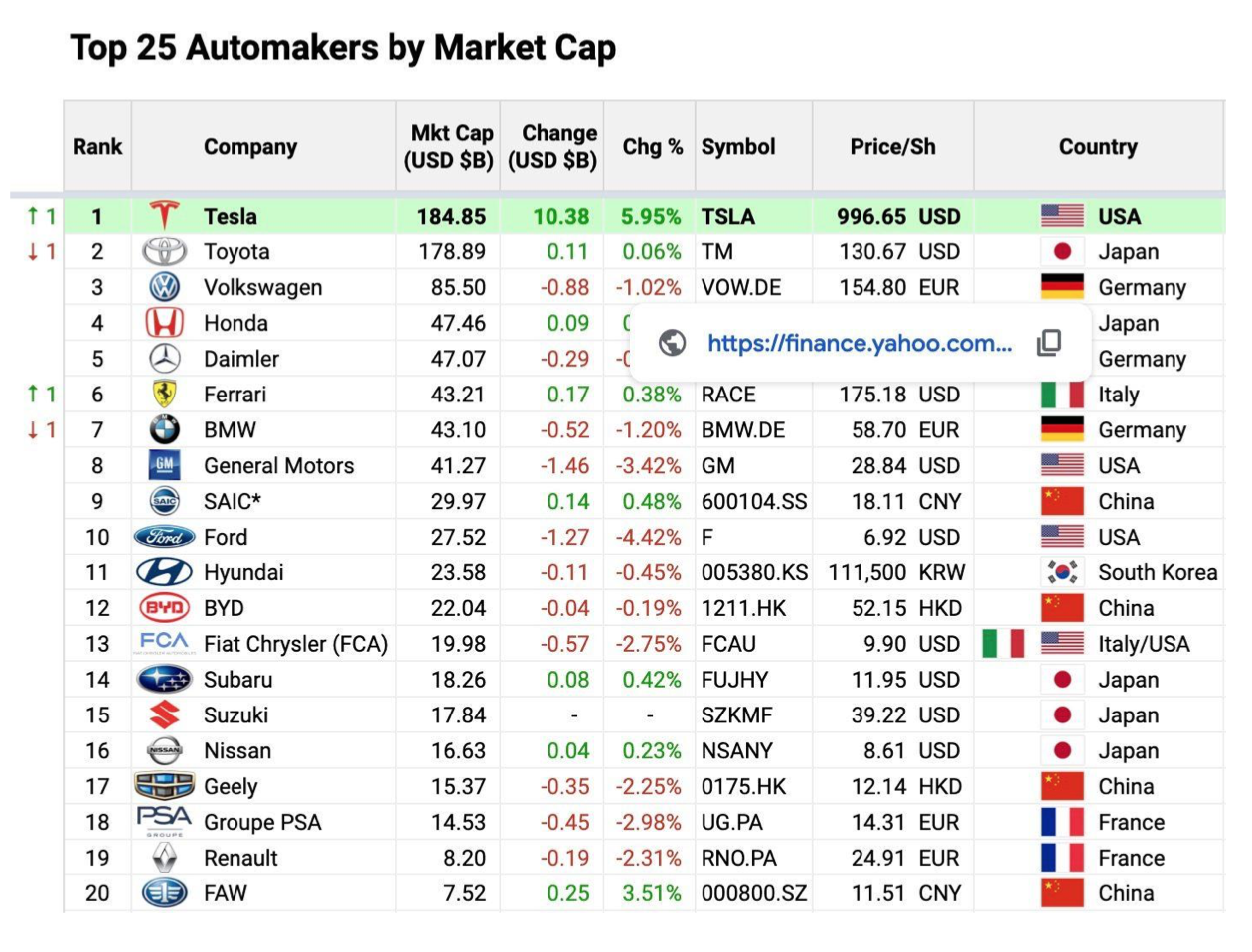

Tesla (at 16 years old) has a market value higher than all other automakers

Tesla highlights the value of having a significantly better product, but acquiring Tesla type of financing for R&D and working capital would be difficult for a small business. However, the financial value of having a positive cash flow in conjunction with steady revenue and earnings growth is one of the best ways for small businesses to acquire capital.

Sources of Financing for Small Business:

During the life of most any business, the owner will need to seek out cash to help with its growth or to keep it going through a rough patch. So, planning how to fund a business is hardly a trivial or brief topic. Indeed, a thorough discussion would take much more space than we have here.

However, we can provide an overview we hope will help start you thinking about your business’ options.

First, there are two ways to externally fund a business: debt and equity. When debt is used, the investor receives a note for his or her cash. The note spells out the terms of repayment, including timing and interest. The benefit of using debt is that you retain ownership of your company. The downside is that you have an obligation to repay. If you fail to meet your commitment, the lender, under certain circumstances, can force the company into liquidation.

Then there's equity. An owner who uses equity to fund a business turns over an ownership stake to an investor in return for the latter's cash. The benefit is that there is no obligation to repay the investor. The downside is the owner has to give up a part of the ownership of his or her business. This can entail losing some control over the company.

There are many different sources of equity and debt funding. We’ll briefly consider several examples.

Equity

Bootstrapping -- The business funds itself. As the business grows, it throws off cash that enables further growth. We know a company that distributes and installs VoIP (voice communications) technology systems. The owner had approached us for an angel investment. After we looked at his books, sales funnel and business model, we turned him down. Instead, we suggested that the owner bootstrap his business. We reasoned that the sales in the pipeline would be sufficient for the growth he planned. He didn’t need outside cash, and we suggested he not sell part of his company.

Self-funding -- Many entrepreneurs fund their businesses themselves. They use savings or personal debt (such as a second mortgage or credit cards). Alternatively, they sell assets to generate cash (e.g., a second home or a boat) for the business.